By Jesse Abercrombie, CEPA®, AAMS™, Edward Jones

If the past few years have taught us anything, it’s that unexpected developments can crop up seemingly out of nowhere and shake the foundations we stand on — creating tremendous uncertainty.

It’s likely that the pandemic had a significant impact on your life and the lives of the people around you. But the fact is, it takes far, far less than a global health crisis to potentially jeopardize the success of a business.

Consider, for example, key person insurance and buy-sell agreements. Many electrical contractors have these solutions in place — and if you’re among them, congratulations. Both can be essential in ensuring your business runs smoothly if you, a partner, or a vitally important employee dies or suffers a disability and can no longer pilot the ship.

But when was the last time you took that paperwork out of the file cabinet and reviewed it? When we ask that question to successful business owners, the two most common answers are “I haven’t” and “It’s been so long I can’t even remember.”

That could spell big trouble. Outdated or insufficient business continuity solutions may not give you the protection you’re counting on when you need it most — which could put your entire operation at risk.

Here’s what you need to know about updating your key person insurance and buy-sell agreement, and how to make it happen now so you’re not blindsided when you can least afford to be.

(Don’t have either key person insurance or a buy-sell? Get on it! Keep reading to learn what these crucial documents can do for the long-term health and stability of your business.)

Key Person Life Insurance

Key person life insurance can be vital in replacing profits or loss of capital due to the death of a critical employee. (It can also provide cash to address loan payments, help recruit and replace key employees, and even fund executive benefits.)

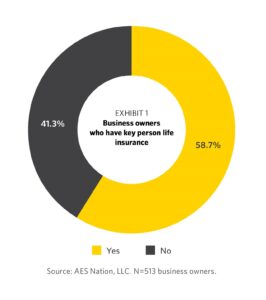

The good news: The majority of the business owners we surveyed have key person life insurance on themselves or someone at their company (see Exhibit 1).

That said, a sizable percentage don’t have this protection in place. For those business owners without key person life insurance, almost three-quarters (73.7 percent) told us that if something should happen to them or another key employee, the business would fail or be significantly handicapped.

The message is clear: If you don’t have key person insurance in place, you almost certainly need it!

Buy-Sell Agreements

When a privately held company has multiple owners and illiquid stock, a buy-sell agreement is usually an extremely wise planning move. The reason: Few business owners want to be in business with the spouse or children of a partner who is no longer able to carry out his or her duties.

A buy-sell agreement is an excellent tool for severing ties in this type of situation. This type of legal contract accomplishes several objectives:

- Ensures that when a trigger event occurs, such as the death of an owner, that person’s equity in the business will be purchased and the proceeds of the sale will go to his or her heirs

- Provides a funding source, such as life insurance, to ensure the liquidity needs of the business are met and make sure the financial demands on the remaining business owners will not be onerous

- Determines a valuation for a deceased owner’s business equity to calculate estate taxes

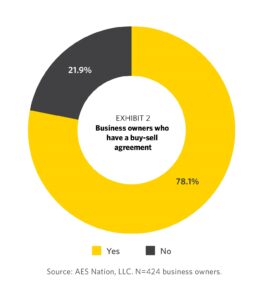

The value of buy-sell agreements is widely recognized, as evidenced by their high level of usage among business owners. According to the business owners we surveyed who had partners in their companies, nearly four out of five had buy-sell agreements (see Exhibit 2).

Old and Outdated?

The news isn’t all good, however. Most of the business owners who took the right proactive steps to protect their businesses with key person insurance and buy-sell agreements haven’t revisited those plans to ensure they’re still adequate and positioned to do exactly what the owners want them to do.

Take key person life insurance. In most cases, the business owners who have this type of policy had not revisited it within the past three years (see Exhibit 3). That means there’s a good chance the key person life insurance in place might not be adequate — or even properly structured — to address the present needs of the company and its owners. Over periods of three years or longer, businesses can (and do) undergo significant changes in terms of their revenue and valuation as well as their organizational structure and leadership. If their insurance and other key financial documents aren’t updated to reflect those developments, businesses can find themselves over- or underfunded in ways that can cause serious problems.

Example: A company’s valuation rose over time due largely to the skills and success of one salesperson at the firm. When he died unexpectedly, the company discovered the salesperson’s key person insurance policy was significantly underfunded because no one had revisited it as the company grew to reflect the salesperson’s increasingly vital role. As a result, the company didn’t have enough insurance money to replace him with a similarly high-caliber salesperson — and it was forced to use money from operations. That put a tremendous financial strain on the firm — and almost sunk it, unnecessarily.

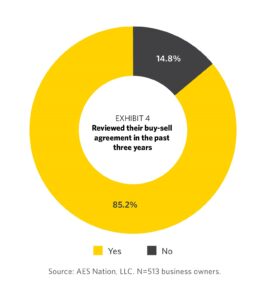

It’s also problematic that so few business owners have reviewed their buy-sell agreements or their funding mechanisms within the past three years (see Exhibit 4). Many business owners reported meaningful changes in the fortunes of their companies in recent years — making it likely that their buy-sell agreements and funding plans are out of date.

Outdated buy-sells can create major problems and even trigger lawsuits. Consider an agreement that was created calling for a $1 million payout to the heirs of one of the partners. If that business’s valuation soars to $10 million because one of the firm’s products is a huge hit, that $1 million agreement may be met with cries of unfair practices and cheating by the deceased partner’s family. Another common problem is that death is usually the only “trigger event” written into buy-sell agreements. Few of these agreements address disability. This oversight could easily hobble many businesses (and their owners), as many will face this situation in their lifetimes.

Dust Off those Documents

We recommend that your key person insurance and buy-sell agreement be reviewed every year or two — and certainly whenever any major changes occur in your business’s financial health, either positive or negative.

The review should be conducted in partnership with a wealth manager who takes the time to learn what’s changed since you put your solutions in place, assesses how those changes might impact the two strategies, and makes recommendations for getting them current and prepared to safeguard your company as you need them to.

If you already work with a highly capable and knowledgeable financial professional who can do this for you, you’re all set. If you do not — or, more likely, you wonder if the professionals with whom you currently work are truly up to the task — you may want to get a second opinion about your business continuity solutions from an elite wealth manager.

Key Takeaways

- Key person insurance and buy-sell agreements are important risk management solutions for entrepreneurs.

- Outdated policies and agreements could potentially fail you when you need them most.

- It’s time to dust off those documents and review them with an expert.

Jesse Abercrombie, CEPA®, AAMS™ is a financial adviser with Edward Jones based in Plano, TX. Jesse has been active with IEC for more than 17 years and can be contacted at jesse.abercrombie@edwardjones.com or (972) 239-0852.