Part three in a 2023 series from Deltek

By John Meibers, Deltek ComputerEase

Job costing is an essential component of construction accounting. With so much to keep track of, it’s easy to let construction projects get out of control — potentially facing expensive surprises further down the line, whether that is due to extra labor, faulty equipment, or simply a loss of potential profits when a project exceeds your original budget.

To maximize your profit and the success of your projects, you need an accurate view of all ongoing work, teams, and individual jobs. Even one small oversight can disrupt the entire project workflow and chip away at your profits. That is why it is more important than ever to plan individual jobs effectively, looking at every element in detail through job costing.

In this article, you will learn everything you need to know about job costing for electrical contractors, from the basics of what it is, to a breakdown of all the costs you need to track, and how job costing software can help to make sure your construction jobs stay profitable.

What is Construction Job Costing

Job costing accurately tracks all costs associated with a job, including labor, materials, and overheads. It gives you a detailed breakdown of an entire project so you can track expenses in real time and easily calculate future profitability.

Many contractors rely on the general ledger to record project expenditure, but it can be difficult to precisely track the ins and outs of a construction job this way. General ledgers are designed to provide a complete overview of your business’s financial health. This means they consider all financial transactions, including accounts payable, accounts receivable, and payroll, rather than just transactions for one job. As a result, tracking and recording individual job costs can be difficult because you are looking at your business’s overall revenue and expenditure, rather than that project alone.

With job costing, you can quickly identify extra expenses that bite into your profit because there is an up-to-date audit trail of all receipts, income, and expenditures on any specific job. If any cost exceeds what you planned, you can immediately identify and potentially rectify the problem.

In most cases, you can predict problems before they arise, like when a job is nearing its maximum budget. In this way, job costing helps you make better operational efficiency and financial health decisions.

Job costing simply adds another layer of tracking. It still forms part of your general ledger, meaning all transactions will be recorded there, too. With construction job costing, however, your project managers can focus on the profit and loss relating to one specific job.

Different Types of Costs and their Role in Job Costing

In construction, it’s rare that two projects look the same. Every job is different, which means costs for overhead also vary. However, regardless of the job you’re working on, expenses can be grouped into three categories: direct costs, indirect costs, and committed costs. Let’s look at them in detail:

- Direct costs are costs that can be directly associated with a particular job, such as hours of labor, materials, tools and equipment, or subcontracts

- Indirect costs are costs that can’t be directly associated with a job but are needed to support the overall job management and completion of the contract. This can include project management fees, estimating, costs of using owned equipment, and indirect labor

- Committed costs are costs that a company has agreed to buy via purchase order or contract. Examples include unposted payroll, open subcontractor agreements, and open purchase orders where you have committed to purchase material that you have not been billed for

Direct, indirect, and committed costs are important in accurately depicting the total job cost. However, indirect costs are often overlooked as they are not directly associated with a particular job. It’s easy to forget the hours of work your project management team needs to track projects and job expenses, or the cost of fuel to run an important piece of machinery. Factoring your overhead is essential for maximizing your job profitability and your overall financial health.

Key Construction Job Costing Terms You Need to Know

Equipment Costing: Equipment costing includes all the machinery and tools needed to complete a job. Remember, some equipment and tools may be purchased, rented, or owned already.

While it’s easy to calculate the cost of bought or loaned equipment, pre-owned tools are more difficult because there are no direct costs. Best practice for equipment costing involves charging a standard rate you would expect to pay for renting the equipment, then calculating your total cost based on your rate.

It’s also important to track equipment beyond the initial purchase price. You’ll need to consider the cost of running and owning the machine, plus fuel and depreciation costs.

To identify equipment costs, you need to consider:

- Revenue: Use, transportation, and costs when left idle

- Cost-to-own: Depreciation, insurance, and interest

- Cost-to-operate: Fuel, overhead, and repairs

Equipment and machinery are expensive assets, which is why it is important to determine accurate rates. You should also take steps to review your inventories regularly so you can assess the cost-to-own and determine whether it’s viable for your business. In addition, create ongoing maintenance schedules to ensure all equipment is in good working order and minimize overhead from faulty machinery.

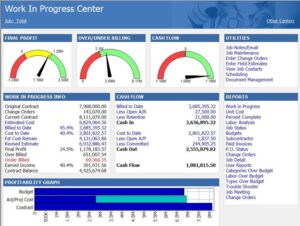

Work in Progress (WIP) Reporting: Work in progress (WIP) reporting is a key part of project management. It allows you to calculate the percentage of work completed to date and compare this with the total amount spent, so you can accurately predict the remaining and final cost of a job.

Work in Progress (WIP) Reporting: Work in progress (WIP) reporting is a key part of project management. It allows you to calculate the percentage of work completed to date and compare this with the total amount spent, so you can accurately predict the remaining and final cost of a job.

WIP reporting is also essential for overbilling and underbilling purposes. Overbilling occurs when you’ve charged more than needed for the work completed, while underbilling means you’ve charged for less than what was earned. For example, you may have completed 50 percent of the work but only billed for 30 percent. If you don’t bill for the missing 20 percent, this could affect your job cash flow and leave you to fund this part of the job. Using WIP reporting is crucial, not just to understand how a job is progressing, but for managing budgets effectively.

Calculating WIP requires five important pieces of data:

- The contract price for the job

- The total cost estimate for the job

- The cost-to-date

- The billed-to-date

- The projected cost to finish the job

With WIP data, you can better predict your job’s outcome. You will know who is where, doing what, and when. It also allows you to pull accurate data reports to help with financial reviews and planning, as you’re able to quantify all past, ongoing, and future work, and allocate budgets accordingly. Use this data to help grow your bottom-line profits.

Committed Costs: Committed costs are anything you’re committed to paying within a project. Job costing software like Deltek ComputerEase will tell you your committed costs and subtract these from your budget, so you can see what is left for additional costs and expenses across every open project.

Some examples of committed costs include:

- Open subcontractor agreements: Costs to cover subcontractors, which may not have been paid yet

- Purchase orders: Open purchase orders for materials, equipment, and other items that you may or may not have ordered yet, but will pay for

- Time from the field: Payroll to cover labor for workers on the field for time that has been reported but not processed through payroll

- Expenses from the field: Purchases made while on-site, such as for materials or other equipment. These are offset against the overall project budget

Electrical contractors may forget to track committed costs, which affects the amount you have left to spend. In some cases, this means you spend more than what’s available, putting your project in a deficit.

How to Calculate Job Costing

How do you calculate construction job costing? It comes down to a simple job costing process based on a calculation of all individual costs. Your total construction job cost is the sum of all overhead. Each category also has its own job costing formula to allow you to determine the overall cost of the job accurately.

Labor Cost: Labor is a huge portion of an overall job cost. You’ll need to accurately determine the total cost of labor for on-site employees and for anyone in-house, such as project and account managers.

In addition to actual labor costs for regular and overtime employees, you need to account for employer-based payroll taxes (burden) as well as costs for providing benefits to employees (fringes).

It’s also crucial to calculate indirect labor costs for in-house workers, such as project managers, account managers, or those in charge of purchasing equipment. Usually, these employees are paid an annual salary, so you’ll need to work out their hourly or daily rate, inclusive of other costs like insurance and tax.

Subcontractor Cost: If you are using a subcontractor, their costs must also be included. Confirm their costs do not exceed the previously agreed upon contract amount.

Materials Cost: Most jobs require new materials such as wires, cables, circuit breakers, and electrical boxes, so you will need to factor this into your total job cost. Calculate how much you have spent toward new material in quantities, accounting for any surplus. Include committed costs for purchase orders you have written but not yet been invoiced for.

Equipment Cost: Most jobs will require the use of equipment. In some cases, you’ll rent equipment, so you can include the direct fee in your overall job cost. However, many jobs also rely on owned equipment, including drills, PPE, and other machinery. You need to make sure you properly allocate costs to the job for the use of your own equipment.

Overhead Cost: Overhead costs for construction jobs are often trickier to determine. These indirect costs include those associated with running your business and managing jobs, such as internet, rent, administration, utility bills, and other company expenses.

While the total fee of each overhead cost is not directly associated with the job, some percentage of each amount will contribute to each job. As a result, many businesses add a percentage to every job to account for overhead costs. For the most accurate job costing, you will need to make sure that all of the overhead is accounted for.

How Job Costing Software Can Help

While construction job costing can be completed manually, it’s time-consuming. Manual entry is also likely to lead to mistakes and errors, which, if not rectified, can significantly affect the productivity and profitability of jobs. Thankfully, electrical contractors can make use of job costing software to streamline processes and improve overall project management.

Key Job Costing Reports

Job costing software also enables managers to pull key cost reports, which can be used for long-term budget and resource planning and to review overall business productivity. These reports include:

- Job cost summary: Companies can review the total cost of jobs and see how effectively budgets were allocated and whether projects were delivered within budget. Job cost summary reports can also help review profit margins and identify potential inefficiencies, such as excessive equipment costs

- Unit productivity: Reports can help business managers understand the cost of units for a specific construction project; it also allows them to determine output by assessing how much was produced per hour. This data is important for analyzing the productivity of a workforce and for future project estimations

- Labor analysis: As well as overall costs, job costing software can pull labor analysis reports to help review the effectiveness and productivity of a workforce. Businesses can look at important data such as actual and estimated labor costs, time spent on jobs, expenses, overtime, and output

Key Benefits of Job Costing Software

So, what are the benefits of job costing software? Aside from removing manual entry and tracking, job costing software offers multiple benefits for the construction industry:

Manage Budgets: Enter desired budgets for each job, with complete oversight of how projects are performing in real time. Job costing software automatically deducts expenses and committed costs, so you can see how much budget is remaining.

Accurately Price Jobs: Better estimate the total cost of jobs by including accurate calculations for overhead. With a complete breakdown of every cost involved, job costing software ensures you have covered all avenues and don’t fall short.

Manage Customer Expectations: Since you have a better understanding of your job as a whole, you can better manage customer expectations in terms of how long jobs will take to complete or the status of a certain phase, and more.

Estimate Cash Flow: Job costing software allows you to see all ongoing projects at once, including profit and loss, billed costs, and to-be-billed fees. This allows for better financial planning, as you’re able to monitor expected revenue as projects move along.

Compare Estimated and Actual Costs: Compare estimated and actual costs: Keep track of how jobs are performing in relation to their actual and estimated costs. Job costing software lets you quickly see the remaining budgets to determine whether projects are on track. Usually, the software can separate this into cost categories, including material and overhead and anything else you’ve customized.

Track Progress: Job costing software gives you complete oversight of projects so you can track WIP and see how far along projects are. This also allows you to predict any possible delays and put contingencies in place before problems arise.

Create Profit Margins: Accurate job cost reports allow you to see your profit margins, so you can review and amend prices as necessary to make sure you stay profitable.

Receive Automated Notifications: Most job costing software platforms send alerts for important job activities such as when payments are sent, budgets are near exceeding, or projects are near completion.

Identify Issues: Job costing software allows you to keep track of all jobs in real-time, so you can identify issues before they arise. For example, if you have nearly exhausted all labor costs for a particular job, you can take steps to review your budget and allocate resources accordingly.

Put simply, job costing in construction accounting software streamlines the entire job costing process, giving you faster and more accurate insights into how much your construction jobs cost.

Construction Accounting Software and Training

As your electrical contracting business grows, construction accounting software can support you in proactively managing jobs, obtaining financial assistance (loans, performance bonds, lines of credit, etc.), maintaining a strong cash position, and staying compliant. Free construction accounting training is offered by Deltek ComputerEase through Construction Accounting University. Register here.

What’s Ahead

John Meibers and Deltek ComputerEase are bringing an educational series designed to guide electrical contractors through the transformation from standard accounting methods to construction accounting methods. Upcoming topics include construction payroll and revenue recognition.

Previous articles in the series are:

The Basics of Construction Accounting (January / February 2023 Insights)

The Complete Guide to Work in Progress (WIP) (March / April 2023 Insights)

John Meibers is vice president and general manager, Deltek ComputerEase. He has more than 35 years of experience serving the construction industry. John has been a leader at Deltek ComputerEase since 2000 serving over 4,500 contractors nationwide. In today’s rapidly changing, fast-paced world, a big part of John’s role is to ensure that Deltek ComputerEase equips customers with the tools they need to manage profitability, drive growth, and meet construction requirements.